oregon tax payment deadline

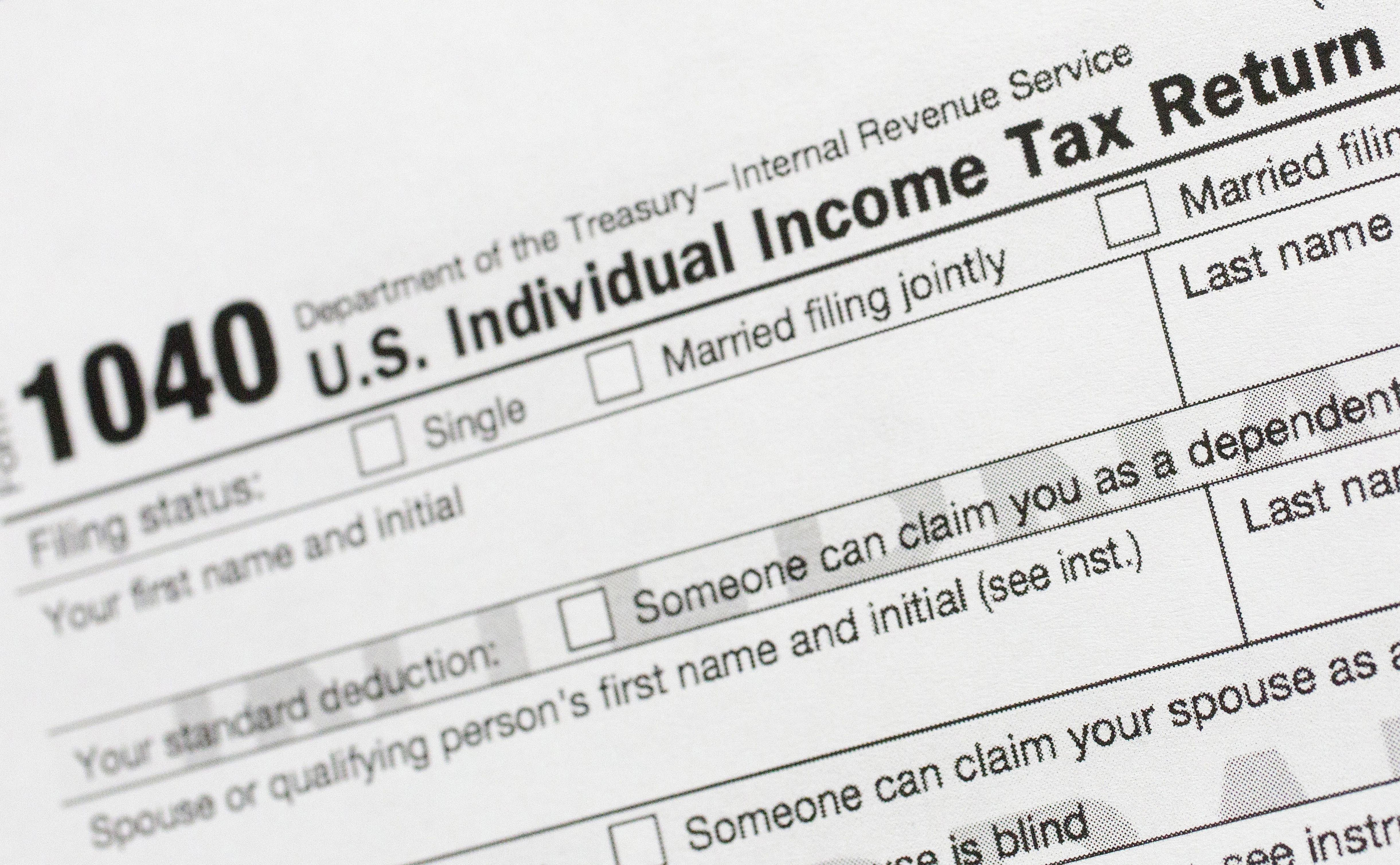

The personal income tax returns filing and payment due date is extended from April 15 2020 to July 15 2020 including. April 15 July 31 October 31 January 31 If you have any questions the tax office is open during regular business hours.

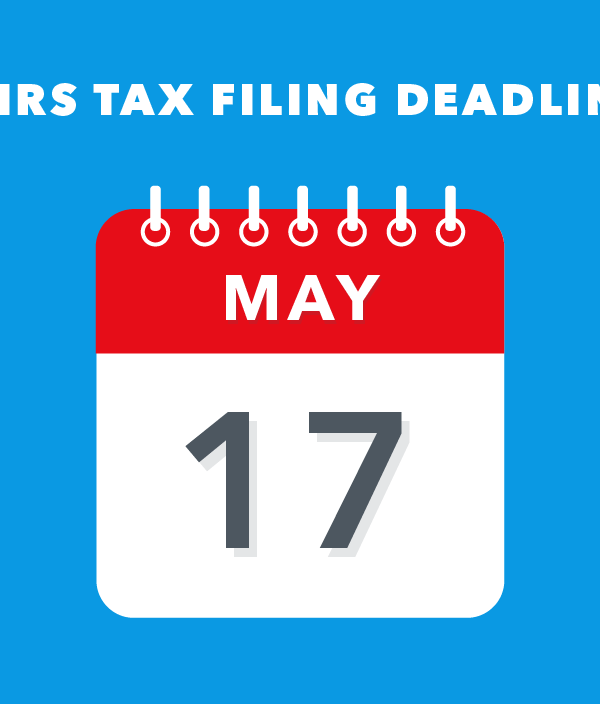

Oregon Bumps Tax Deadline To May 17 In Line With Irs Kval

912022 IRS News for Tax Practitioners Sept 2022.

. What are the specific. Annual domestic employers payments are due on January 31st of each year. Your payroll tax payments are due on the last day of the month following the end of the quarter.

2022 second quarter individual estimated tax payments. Last week the IRS delayed tax filing and tax payment deadlines to July 15 without interest or penalties. The Oregon tax payment deadline for payments due with the tax year 2019 tax return is automatically extended to July 15 2020.

Your 2021 return is due October 17 2022. Payments must be submitted on or before the following due dates. The due dates for estimated payments are.

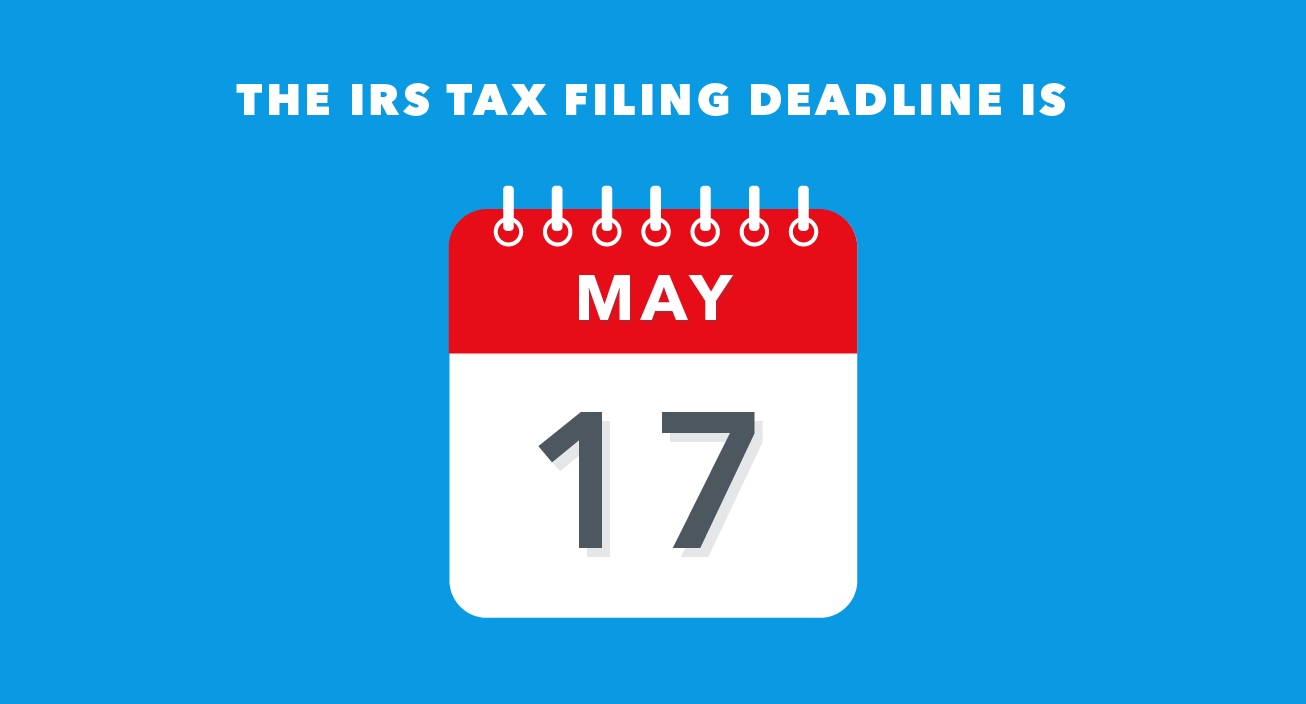

Oregon has joined the Internal Revenue Service IRS in postponing the tax filing and payment due dates for individuals from April 15 2021 to May 17 2021. The oregon tax payment deadline for payments due with the 2019 return by may 15 2020 is automatically extended to july 15 2020. 1 Oregon withholding tax payment due dates are determined by corresponding federal due dates as outlined in the following rules.

IRS Updates Filing and Payment Deadlines From the Coronavirus page you can follow a link to a new web page which describes details about most federal tax filing and payment deadlines. October 17 2022 2021 individual income tax. Estimated tax payments for tax year 2020 are not.

Or make tax payments call 800-356-4222 toll-free English or. September 15 2022 2022 third quarter individual estimated tax payments. What Happens If I Miss The Tax-filing.

Pay full amount by 11152022 for. If you need an extension of time to file and expect to. Corporate exciseincome or personal income.

A timely filed extension moves the federal tax filing deadline and the Oregon filing deadline to October 17 2022. An extension of time to file your return is not an extension of time to pay your tax. The Oregon tax payment deadline for payments due with the tax year 2019 tax return is automatically extended to July 15 2020.

Form OR-40 OR-40-N and OR-40-P Oregon Personal. On Wednesday March 25 Governor Kate Brown announced that tax. 1042022 IRS Newsletter for Tax Professionals October 2022.

Rule 1 If the federal tax due is less than 1000 at the. 912022 Estimated payment deadline coming up 912022 IRS News for Tax Practitioners Sept 2022 832022 IRS News for Tax Practitioners August 2022 7192022 Aug. Late payments will not receive a discount and may incur interest.

912022 Estimated payment deadline coming up. Filing postponed til May 17. With April 15 approaching the Department of Revenue reminds taxpayers that the deadline for filing individual income tax returns for the.

Oregon Kicker Rebate Of 1 4 Billion Tax Revenues Up 1 Billion In Stunning Forecast Oregonlive Com

Oregon Dept Of Revenue Offers 2022 Tax Season Filing Tips Ktvz

Oregon State Tax Information Support

Federal Income Tax Deadline In 2022 Smartasset

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Tax Payment Information Jefferson County Oregon

Kuow Washington And Oregon Have A Tax Off Who Wins

Oregon Reminds That Tax Filing Deadline Is April 18 News Kdrv Com

First Filing Deadline Of 2012 Final 2011 Estimated Tax Payment Due Jan 17 Don T Mess With Taxes

Who Must Pay Oregon Income Tax

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Understanding Your Property Tax Bill Clackamas County

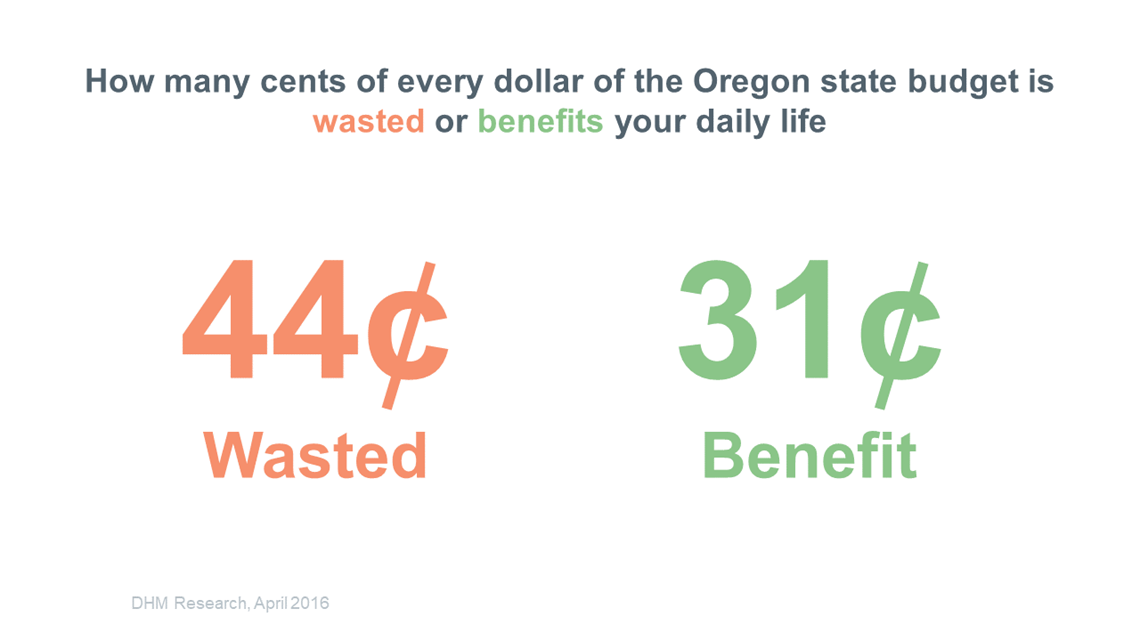

What Do Your Federal And State Taxes Pay For Kgw Com

Income Tax Filing Deadline Moved To July 15 From April 15

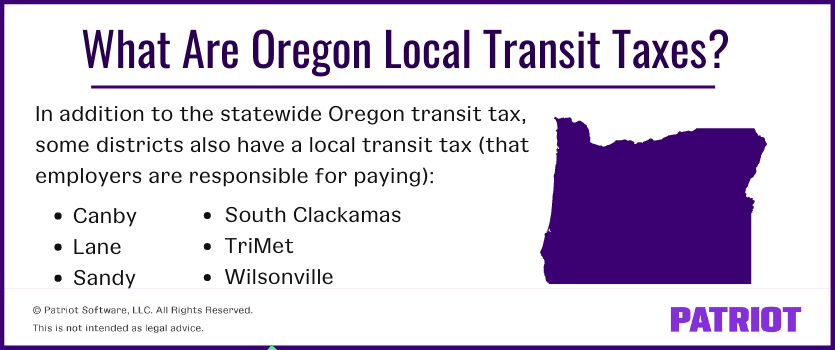

What Is The Oregon Transit Tax Statewide Local

Oregon Irs Extend Tax Filing Deadline To May 17 Due To Covid 19 The Internal Revenue Service Is Pushing Back The Tax Filing Deadline By A Month Income Taxes And Payments Will Now

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems